Get the free form 4562 2010

Show details

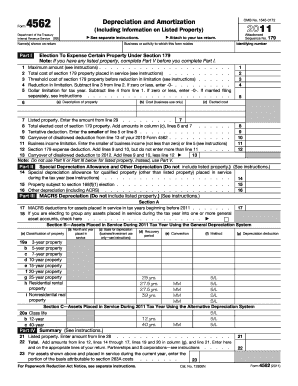

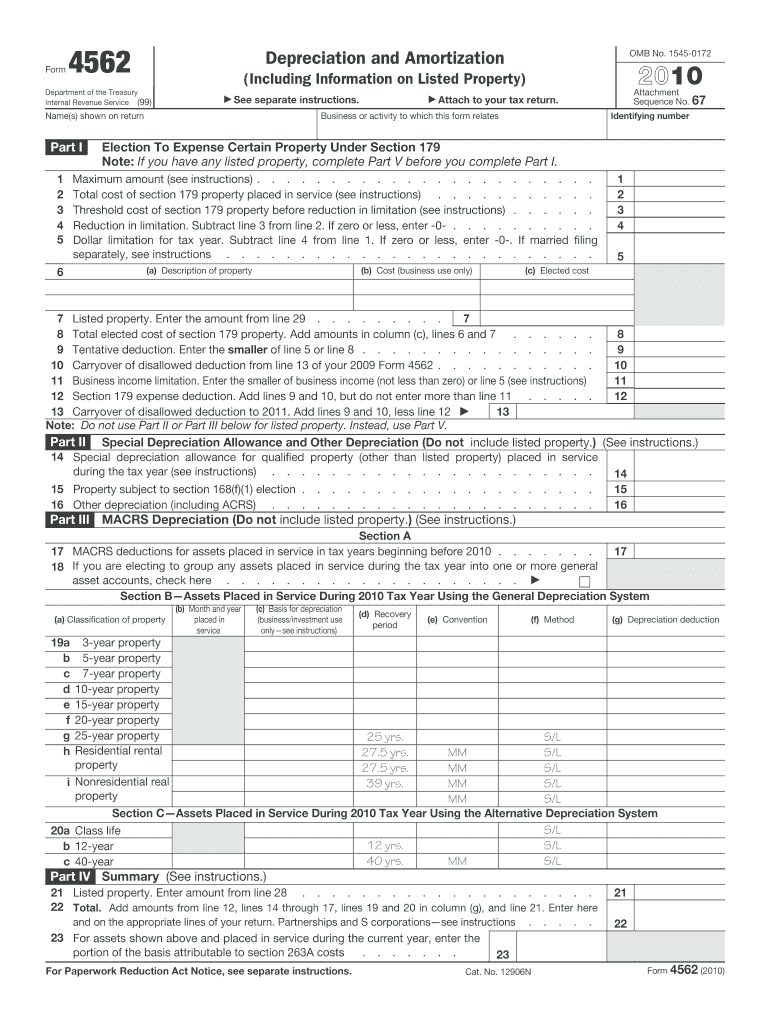

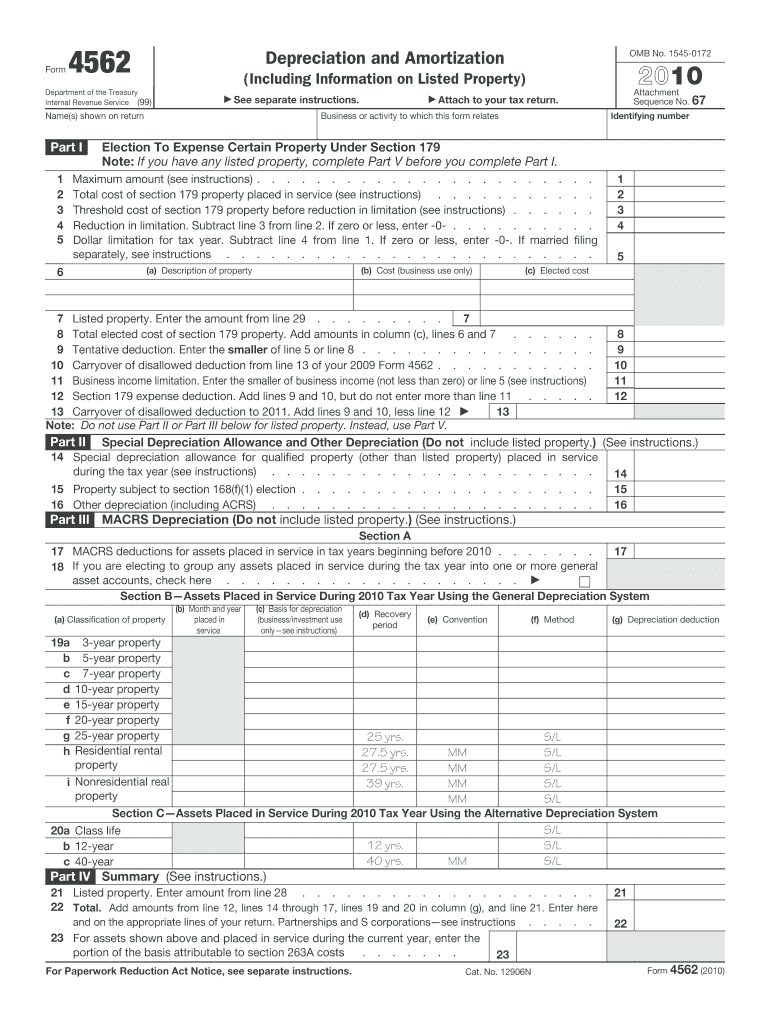

Cat. No. 12906N Form 4562 2010 Page 2 entertainment recreation or amusement. Part V Note For any vehicle for which you are using the standard mileage rate or deducting lease expense complete only 24a 24b columns a through c of Section A all of Section B and Section C if applicable.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 4562 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4562 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4562 2010 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4562 2010. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out form 4562 2010

How to fill out form 4562 2010?

01

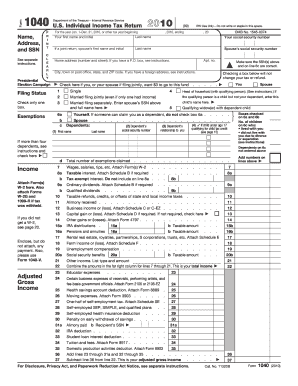

Start by entering your name, social security number, and address in the designated spaces at the top of the form.

02

Provide the necessary information about the property for which you are claiming depreciation or amortization. This includes the description, date placed in service, and cost or basis of the property.

03

Calculate the depreciation or amortization expense for each property using the appropriate method, such as straight-line or accelerated.

04

Enter any Section 179 expense deduction if applicable.

05

If you have any listed property, such as a car used for business purposes, provide the required details such as the date placed in service, business-use percentage, and total mileage.

06

Include any special depreciation allowances or bonus depreciation if applicable.

07

Summarize the totals in the appropriate sections, including the total depreciation or amortization expenses.

08

Attach form 4562 to your tax return and retain a copy for your records.

Who needs form 4562 2010?

01

Business owners who have acquired property for business use and are claiming depreciation or amortization expenses on their tax returns.

02

Individuals who have listed property, such as cars used for business purposes, and need to report the relevant details for tax purposes.

03

Individuals or businesses who qualify for special depreciation allowances or bonus depreciation and need to include these deductions on their tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4562?

Form 4562 is a tax form used by individuals and businesses to report depreciation, amortization, and other types of property expenses incurred during the tax year. It is commonly used to claim deductions for the depreciation of business assets, such as vehicles, machinery, equipment, and buildings. The form is filed as part of the individual or business tax return (Form 1040 or Form 1065) and helps taxpayers calculate their allowable deductions for the cost of acquiring, improving, or using property for business purposes.

Who is required to file form 4562?

Form 4562, Depreciation and Amortization, is required to be filed by individuals, partnerships, corporations, and other entities that need to report the depreciation and amortization expenses of business assets for tax purposes. This form is used to claim deductions for depreciation, amortization, and to report any changes to prior depreciation amounts.

How to fill out form 4562?

Form 4562, also known as the Depreciation and Amortization form, is used to report depreciation and amortization expenses for business assets. Here is a step-by-step guide on how to fill out form 4562:

1. Enter your name, Social Security number or Employer Identification Number (EIN), and address at the top of the form.

2. On Part I - Election to Expense Certain Tangible Property, if you want to elect to expense certain assets under Section 179, enter the year you placed the assets into service and the cost of these assets in column (e).

3. On Part II - Information on Your Vehicle, if you're claiming depreciation for a vehicle used for business purposes, provide the necessary information about the vehicle including the date placed in service, total business and commuting mileage, and any personal use percentage.

4. On Part III - MACRS Depreciation, you will need to fill out columns (b) through (g) for each asset on which you're claiming depreciation. Enter the description, date placed in service, cost or other basis, and depreciation method used.

5. On Part IV - Summary, add up the depreciation expenses for each asset in column (g) and enter the total. This will be the amount you claim as depreciation expenses.

6. If you have any listed property (e.g. computer, camera, etc.) used for both business and personal purposes, you may need to complete Part V - Listed Property.

7. Next, calculate your special depreciation allowance on Part VI, if applicable, for qualified property purchased after September 27, 2017, and placed in service during the tax year.

8. Lastly, if you're claiming any amortization expenses for certain business start-up or organizational costs, complete Part VII - Amortization.

Remember to carefully review your completed form before submitting it to ensure accuracy. It’s always a good idea to consult a tax professional or utilize tax software for assistance with filling out complex forms.

What is the purpose of form 4562?

The purpose of Form 4562 is to report the depreciation and amortization expenses for assets purchased for business use. It is used by businesses and individuals to claim deductions for the cost of acquiring and improving assets such as buildings, vehicles, machinery, and equipment that are used in the production of income. The form is also used to report the election to expense certain property under Section 179 of the Internal Revenue Code.

What information must be reported on form 4562?

Form 4562, also known as the Depreciation and Amortization form, is used to report the details of property and equipment depreciation or amortization expenses for a business or rental property. The following information must be reported on Form 4562:

1. Description of Property: Provide a brief description of the property being depreciated or amortized, such as the type, make, and model.

2. Date Placed in Service: Specify the date when the property was first used or made available for use.

3. Cost or Other Basis: Report the original cost or other basis of the property to calculate depreciation or amortization expense.

4. Method/Convention: Indicate the depreciation or amortization method used, such as the Modified Accelerated Cost Recovery System (MACRS) for tangible property or the straight-line method for intangible property. Also, mention the depreciation convention (e.g., mid-month, mid-quarter) used to determine the depreciation or amortization calculation.

5. Prior Year Section 179 Deduction: If the property claimed the Section 179 deduction in a prior year, report prior-year deductions for that property.

6. Section 179 Expense Deduction: Report the current year's Section 179 expense deduction for each property if applicable.

7. Bonus Depreciation: If the property qualifies for bonus depreciation, report the portion of the property's cost eligible for this special depreciation deduction.

8. Depreciation/Amortization Deduction: Calculate and report the annual depreciation or amortization expense for each property, based on the appropriate method and convention.

9. Carryovers: Include any carryovers from prior years, such as unused amounts from Section 179 deductions or excess depreciation.

It is important to carefully fill out Form 4562, ensuring accurate reporting of property and depreciation details for tax purposes.

When is the deadline to file form 4562 in 2023?

The deadline to file Form 4562 in 2023 is April 17, 2024. This is assuming it falls on a regular tax year, typically the deadline for filing tax returns is April 15th. However, if April 15th is a weekend or a holiday, the deadline may be extended to the following business day. It's always recommended to check with the IRS or a tax professional for the most accurate and up-to-date information regarding tax deadlines.

What is the penalty for the late filing of form 4562?

The penalty for late filing of Form 4562, which is used to claim depreciation and amortization deductions, is $270 per form, as of the tax year 2021. However, if the late filing is due to reasonable cause and not willful neglect, the penalty may be waived by the IRS. It is always recommended to file tax forms on time to avoid any penalties or interest charges.

How do I modify my form 4562 2010 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 4562 2010 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit form 4562 2010 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 4562 2010 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the form 4562 2010 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 4562 2010 in seconds.

Fill out your form 4562 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.